The fight against climate change demands proactive and innovative solutions. In 2021, the European Union set forth its ambitious strategy – the European Green Deal – aiming to make Europe climate-neutral by 2050. A key component of this ambitious plan is the Carbon Border Adjustment Mechanism (CBAM), a policy that has sent ripples through the world of international trade. Understanding CBAM better is crucial for businesses, particularly in countries like India, to navigate the changing landscape and prepare for its full implementation.

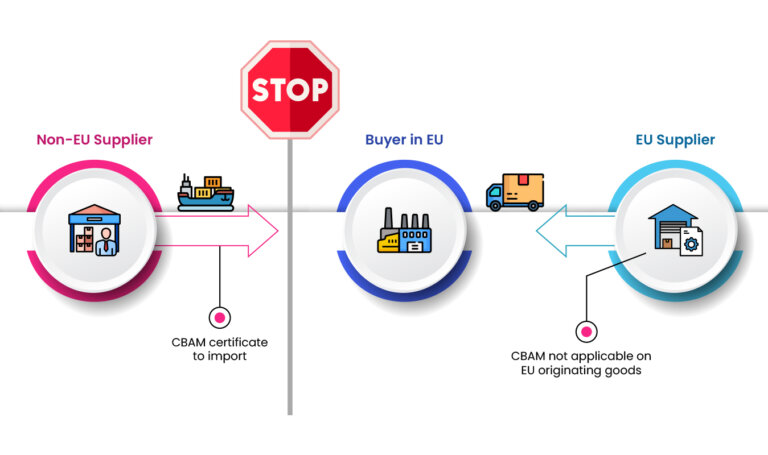

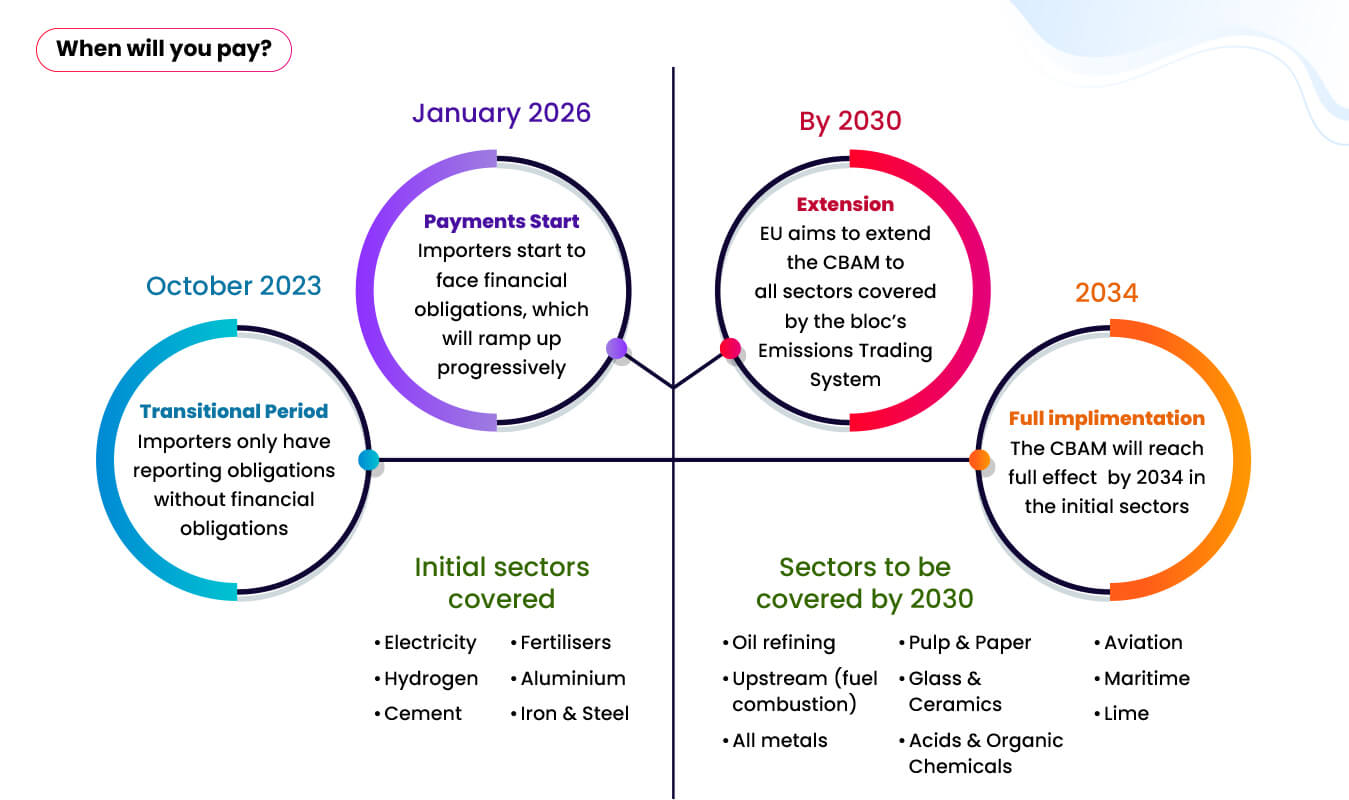

In essence, CBAM is a levy imposed on the embedded carbon emissions in certain imported goods entering the EU. This essentially “prices in” the cost of carbon used in their production, aiming to level the playing field between European companies subject to the EU Emissions Trading System (ETS) and their competitors from countries with less stringent environmental regulations. Initially, CBAM targets high-emission products like iron and steel, cement, fertilizers, aluminum, and electricity.

Two primary concerns drove the EU towards CBAM:

With its gradual implementation beginning in 2023 and full effect starting in 2026, CBAM is expected to significantly impact global trade patterns. Here are some potential effects:

Shift in production bases: Companies producing targeted goods in countries without carbon pricing might consider relocating their production to the EU or investing in cleaner technologies to avoid the CBAM levy.

Rise in product costs: As the carbon cost is factored into the price of imported goods, consumers might experience an increase in prices for products covered under CBAM.

International trade disputes: The legality of CBAM under World Trade Organization (WTO) rules is still under debate, raising the possibility of trade disputes between the EU and its trading partners.

Effect on India:

India is a significant exporter of several goods targeted by CBAM, including steel and cement. This means Indian companies will have to adapt to the new regulations to maintain their access to the EU market.

This might involve:

MITCON, a leading provider of sustainability and compliance solutions, is ideally positioned to assist Indian companies in navigating the complexities of CBAM. We offer a wide range of services, including:

The Carbon Border Adjustment Mechanism is a transformative policy that will reshape global trade in the coming years. While it presents challenges for exporters like India, it also opens opportunities for those who adapt and embrace the shift towards a more sustainable future. By understanding CBAM and seeking expert guidance from organizations like MITCON, Indian companies can successfully navigate this evolving landscape and ensure their continued success in the global market.

Connect with us for MITCON services in CBAM.

“As a global consultant to businesses and organizations worldwide, we can help you to navigate the complexities of the environment, energy transition, business advisory, skill development and identify opportunities for cost-effective savings in your operation”.